Foreclosure is a topic that, unfortunately, many people don’t know much about. Most people have heard the term and may talk about it a decent amount, but very few know how the foreclosure process works or how it affects your credit report. Not only that, but the process differs from state to state, which only adds to the confusion. But this article will teach you the basics of foreclosure so that you can understand the different stages and the best ways to avoid it.

What Is Foreclosure?

Foreclosure is the legal process by which a lender takes back and sells a house due to the homeowner failing to make mortgage payments.

When talking about the foreclosure process, it is helpful to define a few terms:

- Foreclosure: the process by which a lender repossesses a property when mortgage payments aren’t made

- Home in Foreclosure: A house where the homeowner has missed mortgage payments and the lender has started the foreclosure process (also known as pre-foreclosure)

- Foreclosed Home: A home that has gone through the foreclosure process and is now owned by the bank – called REO (real estate owned) in the investing world

How Does Foreclosure Work?

First, let’s discuss a little bit of real estate terminology. So many people say they are going to the bank to get a mortgage, but technically, that isn’t wholly correct. You go to the bank to get a loan. The mortgage is the document that says that the house serves as collateral if you don’t pay back the loan as described in the promissory note.

Promissory Note: a document describing the details of the loan such as original balance, interest rate, term, and monthly payment

Mortgage: a document that ties a house to a promissory note and sets the home as collateral if the homeowner defaults on the payment

This mortgage is filed against the house after closing and becomes a lien. Once the loan is completely paid off, the lender files a release of mortgage which releases this lien.

What Causes Homeowners To Go Into Foreclosure?

Since the real estate crash in 2008, mortgage companies have tightened down on their restrictions for new loans. This includes requirements on credit score, debt-to-income ratio, and other personal finance metrics. However, even with all of these checks, circumstances in people’s lives change, and they go into mortgage default.

Unforeseen Circumstances

Many personal circumstances can contribute to missed payments. Here are the most common ones:

- Loss of job

- Medical issues

- Business failure

- Extracurricular debt

- Divorce

- Loss of loved one

- Unexpected expenses

Increasing Mortgage Payment

Although most home loans have a fixed interest rate, some have an adjustable rate that increases after a set period. Unfortunately, many buyers don’t consider this increase and are shocked by their new payment once the interest rate increases. Many simply can’t keep up with the new payments, which causes the lender to begin the foreclosure proceedings.

Even with a traditional fixed-rate loan, the payment can still go up based on increased insurance premiums and property taxes. These payments are typically lumped into monthly mortgage payments. Taxes and insurance are proportional to home value, so it is likely for your payment to increase slightly in an appreciating market. Unfortunately, many people budget so tightly that even small payment increases give them difficulties.

Upside Down Loan

Most homeowners have at least some incentive to try to pull themselves out of foreclosure to save the equity they have in their homes. However, this isn’t always the case. If a home has gone down in value since the owner purchased it, it may get to a point where it is underwater.

A home becomes underwater when it has negative equity, meaning that it is worth less than the underlying loan amount. This is extremely common in real estate correction cycles after people buy at the top of the market when home prices are over-inflated.

A homeowner’s options in this situation are limited because it’s tough to even sell the house and get out from under it. This often leads to people abandoning their homes because they don’t know what else to do. A better option for everyone, including the lender, is to do a short sale, which means selling the house for less than what is owed on the loan. We’ll discuss this in more detail later.

The Foreclosure Process

There are two types of foreclosures, and the state you are in generally dictates which one is used.

Judicial Foreclosures: The lender must go to court to get a judgment in order to foreclose.

Non-Judicial Foreclosures: No court action is required.

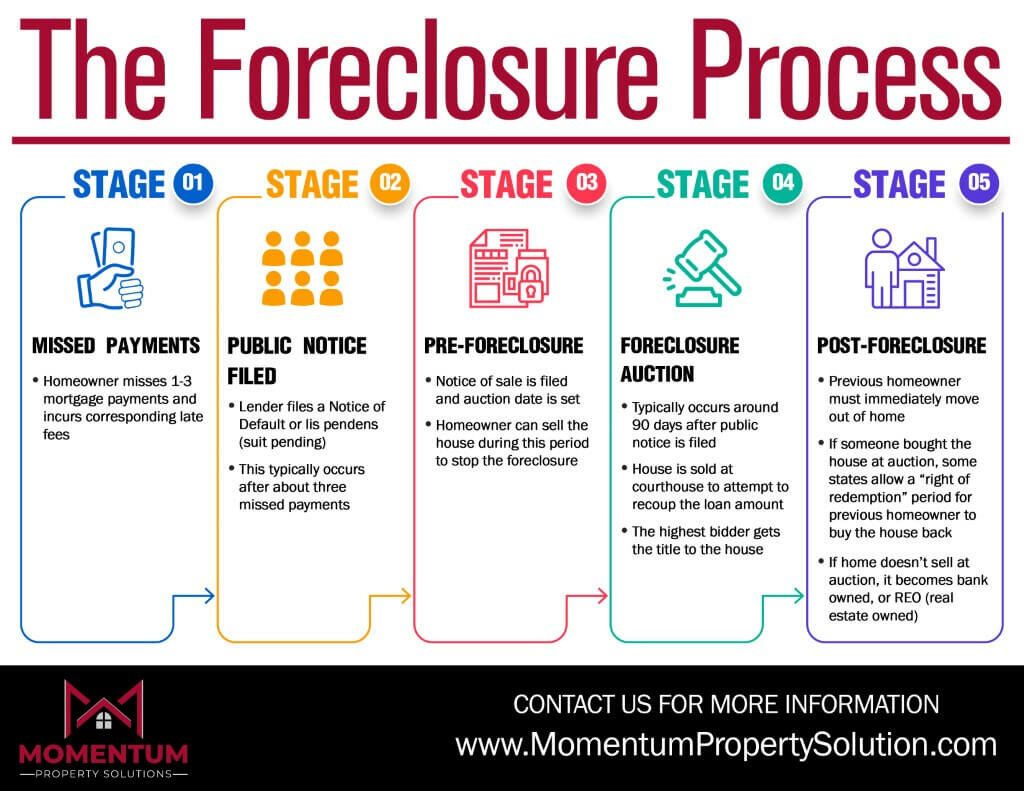

Beyond the two different types of foreclosures, each state differs slightly in the specifics of how they are handled. However, the process can be explained by five stages.

Stage 1: Missed Payments

The foreclosure process always begins with missed payments. As soon as a homeowner gets behind, the mortgage lender has the right to begin foreclosure proceedings. However, banks don’t necessarily want to foreclose. It is a lengthy and expensive process. And after all, banks make money by collecting interest.

Take Early Steps To Avoid Foreclosure

If it is early in the process there have only been one or two payments missed, it may be possible to resolve the situation before it gets any more serious. Lenders offer different options to help delinquent homeowners get back on track. Here are a few common solutions:

- Loan modification

- Repayment plan

- Financial counseling

- Forbearance

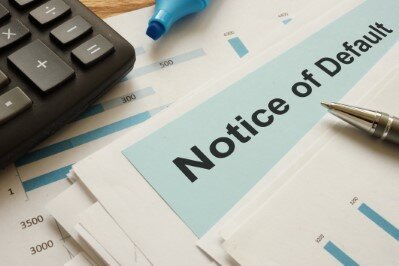

Stage 2: Public Notice

Once a homeowner is significantly behind on payments, the lender will file a public notice indicating that they are proceeding with a foreclosure. This is either a Notice of Default or lis pendens, which means “suit pending.” This filing goes in the public records, so anyone with access to the appropriate database will know about it. This is when homeowners behind on their mortgage loan begin getting bombarded with information from attorneys, loan modification specialists, agents, and investors.

Stage 3: Pre-Foreclosure

After the public notice has been filed, the mortgage lender will typically file a Notice of Trustee’s Sale and set an auction date to sell the property. Homeowners generally have somewhere around ninety days from this point to bring their loan current, or it will be sold at an auction. Here are the most feasible solutions to avoid foreclosure.

Bring The Loan Current And Resume Making Payments

In theory, this is the cleanest solution to stop a foreclosure. If the missed payments plus any accrued fees are paid back, the loan will be reinstated, and everything will be back to normal. However, this usually isn’t feasible for homeowners behind on multiple payments since the reason for missing payments is typically some type of financial hardship to begin with. Nevertheless, homeowners with this option can get back on track the easiest.

Sell The House To Pay Off The Loan

For many homeowners in foreclosure, this is the best option possible. When a house is sold, the proceeds go toward paying off the loan, and any extra money after that goes to the seller. Homeowners with a decent amount of equity have the luxury of selling their house for a high enough price to pay off their loan plus any missed payments.

One easy way to sell a house in foreclosure is to sell it to a cash buyer. This works well because they will buy it fast and completely as-is, which cuts out the time to get the house show-ready and listed. In foreclosure, time is of the essence, and cash buyers can offer speed.

Get A Short Sale Approved By The Lender

A short sale occurs when a house is sold for less than the underlying loan on the property. Because the bank will technically be taking a loss on this type of transaction, they must approve every short sale.

Short sales are prevalent in down markets where many homes are upside down with negative equity. In these cases, lenders are more likely to approve this type of sale because they will end up losing less money in the long run. Foreclosed properties are bad for banks’ books.

Although short sales do affect homeowners’ credit scores, the effects are not nearly as devastating as an actual foreclosure.

Deed In Lieu Of Foreclosure

A deed in lieu of foreclosure is an agreement where the homeowner deeds the property to the lender, and the lender releases them of all mortgage responsibilities. Like a short sale, this option does have a negative effect on a credit score, but not near the impact of a foreclosure.

Although a deed in lieu of foreclosure is a viable option, the lender must be on board with it. For this to happen, the bank must see it as their best option. Once they are deeded the house, it becomes real estate owned (REO), and they will have to sell it just like any other foreclosed property they take back. However, they can save themselves some money and trouble by taking it back earlier instead of going through the entire foreclosure process.

Stage 4: Foreclosure Auction

Once the lender files the Notice of Trustee’s Sale, a date and time are set for the foreclosure auction. The house will be sold here unless the borrower’s back payments are resolved before this date. At the auction, it is typical for several foreclosed homes to be auctioned off in succession. This sale is most commonly held directly on the courthouse steps, but it could also be held in a meeting room.

How The Auction Works

The lender usually sets the starting bid for the auction as the current loan amount. Depending on the amount of interest in the property, the price will be bid up until the highest bidder wins it. These auctions are very popular for investors trying to snag a discounted house, and the bidding can get pretty high sometimes.

Right of Redemption Period

Although the highest bidder at the auction gets the deed to the house, many states have a “right of redemption“ period. During this period, the previous homeowner has the right to redeem the property by repurchasing it at either the purchase price or the total loan balance plus any fees charged by the bank to recoup costs from the foreclosure. The redemption period rules and timeline vary from state to state.

Stage 5: After The Foreclosure

Immediately after the foreclosure sale, the previous homeowner must vacate the property if they haven’t already done so. At this point, the new homeowner can do with the house as they please, keeping in mind the right of redemption. However, in reality, the redemption right is rarely exercised since it requires a lump sum to be paid, and most people that just went through foreclosure simply don’t have that.

What If No One Bids On The House?

If no one is willing to pay the starting bid price on the house set by the lender, the lender will take the house back. This is called an REO or real estate owned. It is required for the homeowner to move out of the house immediately in this case as well because the bank will begin trying to sell the house to recoup their money so they can lend it again.

Banks do not want to get to this point if they don’t have to, because they make money by lending money – not selling real estate. Also, it is typical for houses that get to this point to be in major disrepair, which makes them even harder to sell. This may incentivize a lender to work out a solution with the homeowner before the auction takes place.

A Foreclosure Should Be Avoided At All Costs

As you can see, foreclosure is a challenging and complicated process. However, there are ways that homeowners can prevent it. Whether it be a loan modification, a forbearance, or selling the house, it is crucial to make a total effort to avoid the devastating credit impact of a foreclosure. The effects stay on a credit report for up to seven years, and it will be difficult to get a new loan or even rent during that time.

If you are facing foreclosure or even at risk of getting behind on payments, we recommend researching your options now. Taking action early is your best chance at avoiding foreclosure and saving your credit. With the information you now know, you are much better equipped to handle this situation and move on with your life.