With the crazy market fluctuations we’ve seen over the past couple of years, many homeowners are wondering, “How much is my home worth?”

The problem is that there are countless home value estimates available to homeowners – Zillow Zestimate, letters from agents, the house that sold down the street, and more!

Since there can be quite a discrepancy between these values, they can’t all be right!

The truth is that your home is worth whatever someone is willing to pay for it. But you won’t know that until you list it and get offers.

So how do you get an estimate of what your house is worth without putting it on the market?

That’s precisely what we’re going to show you in this article. As real estate professionals that have evaluated over 100 deals, we’ll discuss the most common options and share with you how approximate the value of every home we look at.

How Accurate is the Zillow Zestimate?

Nearly every real estate website provides an estimated value of every home in their database, with the Zillow Zestimate being the most popular.

However, each of these home value estimates is calculated using an algorithm. It’s not like they’ve personally looked at every house and performed a detailed appraisal. All they can do is reference the available data from public records on previously sold homes in your area and base their estimate on that.

The problem with these estimates is that they don’t have anyone in the loop making decisions and applying common sense. For example, there may be homes that have sold near yours but are entirely different. Or, they might have sold under a distressed situation. An appraiser would exclude these properties from their home value estimate, but online tools include them because they don’t know any better.

Here’s the bottom line.

As home buyers in Huntsville, AL, we never use the Zestimate when evaluating a property and don’t know any real estate professionals that use it either. The Zestimate is often highly different than the value we calculate on a property using more accurate methods.

What is the Zestimate Good For?

Although the Zestimate should not be used to accurately predict the value of your home, it is helpful to visualize market trends. Zillow gives a Zestimate history on each property, and this can be used to understand whether homes in an area have increased or decreased in value over time.

Aside from the Zestimate, Zillow also aggregates large amounts of real estate data that can be extremely useful in tracking market movements. Many real estate professionals rely on this data to understand market shifts, which have been highly prevalent over the last couple of years.

The Best Way to Estimate Your Home’s Value

If you can’t use the Zestimate to determine the value of your home, what are you supposed to do instead?

Basically, do what Zillow is trying to do, but better.

You need to look at houses similar to yours that have sold recently in your area. This is what is called a comparative market analysis.

The way you can do this better than Zillow is by only looking at houses that are actually similar and disregarding the ones that aren’t.

Let’s dive into what this process looks like.

What is After Repair Value (ARV)?

After Repair Value (ARV) is a value that we as house buyers use when evaluating a house we are looking to flip. It is what we expect the home to be worth after we fix it up.

Because the homes we will base the value of the subject property on are in good shape, we use this information to project what it will be worth at the end of our project.

Obviously, the house we are going to fix up is not worth the ARV before we make any repairs.

Your house might be in a similar situation where most of the homes that have been sold are more updated than yours.

That’s okay! You can still use the process we’re going to show you. You will just need to factor in the cost it will take to make your house as nice as the recently sold homes when calculating your home’s value.

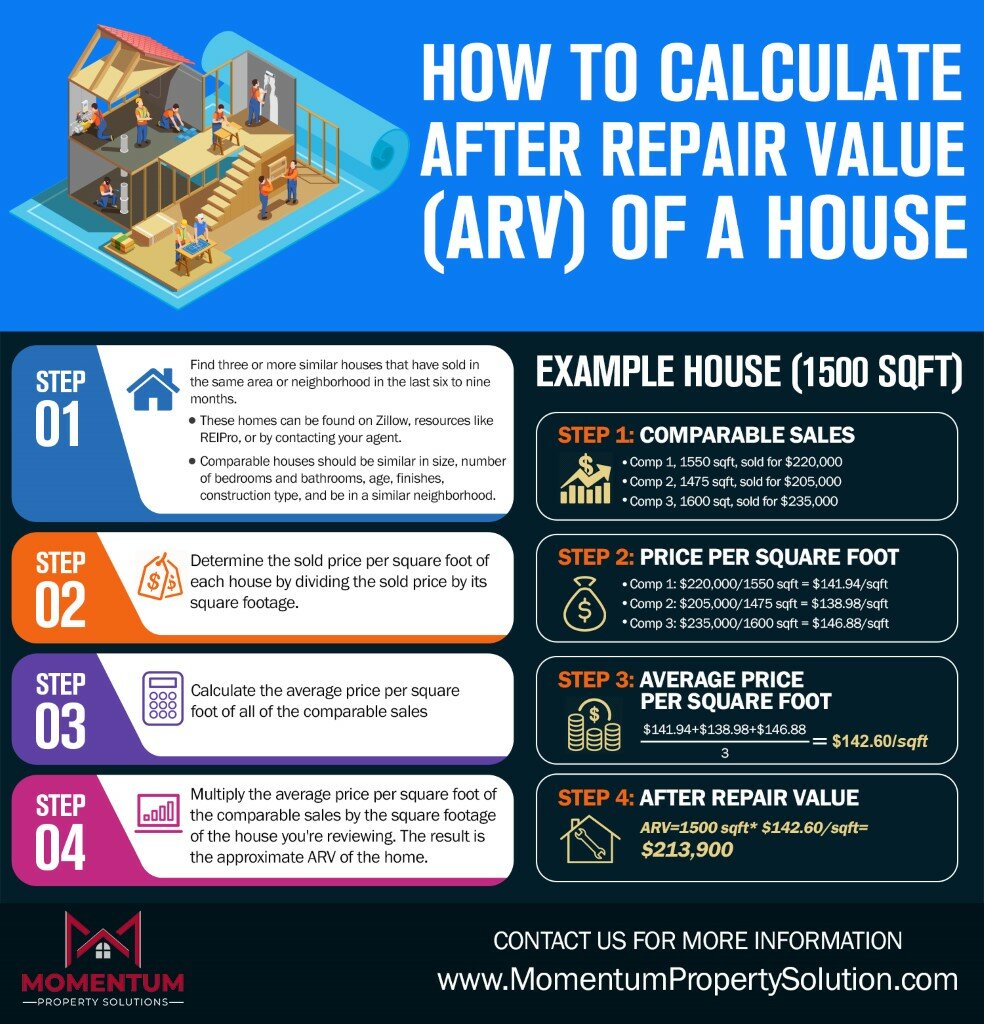

Step 1: Finding Comparable Sales

The first step in determining the value of your home is finding comparable sales. You can do this by going on Zillow and filtering by recently sold homes.

What constitutes a comparable sale? Here are some property details you should be looking for:

- Ideally sold within the last six months

- In same or very similar neighborhood as subject property

- Similar in number of bedrooms and bathrooms

- Within +/- 10% in square footage

- Similar in finishes and updates

It is best to find three or four comparable sales to give you a good average. Be sure to leave out any outliers. If most of the homes sold for $150 per square foot and one sold for $90 per square foot, you should exclude that one from your list.

While it is best to find homes with similar finishes as yours, this isn’t always practical. If your home is outdated compared to the ones included in your analysis, you will just need to account for that in your estimate.

Step 2: Price Per Square Foot of Comparables

Once you have three or four comparable sales, you need to determine the price per square foot that each one sold for. If you are looking on Zillow, it usually gives that value under the price and tax history. Otherwise, you can calculate this by dividing the sales price by the home’s square footage.

For example, if a 1,400 square foot home sold for $175,000, its sold price per square foot would be $125 per square foot.

Step 3: Calculate the Average Price Per Square Foot

Now that you know the sold price per square foot of the comparable sales you have selected, you must calculate the average price per square foot. This value will be applied to your home to determine its value.

To calculate the average price per square foot, you will need to add the values for each home and then divide by the number of comparables you are using.

For more information on calculating the average price per square foot, check out our infographic above. We’ve laid out an example calculation for you.

Step 4: Determine What Your Home is Worth

Once you know the average price per square foot that homes are selling for in your area, you can use that to determine your home’s worth. Simply multiply the average price per square foot by the square footage of your home.

Remember, this value is the After Repair Value. If your home is not in the same condition as the comparable sales you were using, this needs to be accounted for.

To get a ballpark figure, you can subtract off what it would cost to repair and update your house to the same level as the recently sold homes. However, this doesn’t always predict what someone would be willing to pay, because they will often look to buy it below that value as a concession for taking on the extra work to fix it up. Check out how we calculate offers on houses that need repairs!

Aside from finishes, other factors can affect your home’s value. If your home has extra amenities such as a pool or detached workshop, they can raise its value above the ARV you calculated.

Want to Figure Out What Your Home is Worth?

If you follow the steps we’ve discussed, you will have a very good idea of how much your home is worth. However, running a comparable market analysis isn’t for everyone, especially if your home needs repairs or updates.

If you’d like to get an understanding of your home’s value, reach out to us and we can help you! Not only will we give you a home value estimate, but we’ll also make you an offer to buy it from you as-is so you don’t have to stress about getting it market-ready.