Would you like to make an extra $60,000 per year by flipping houses?

Sounds great, right? In fact, you may determine that the income from house flipping is lucrative enough to be a full-time real estate investor.

So why is everyone not flipping houses?

Well, many people are. But unfortunately, a large majority are unsuccessful and end up losing money or deciding it is not worth the effort and hassles.

Flipping a house is extremely complicated, but many people don’t realize that and get into it because they are excited by the dollar signs and the idea of transforming a run-down house into something beautiful.

Becoming a house flipper is not impossible though. We’ve renovated over a dozen houses, some of which have been highly profitable.

We have gained a ton of experience along the way, and we’re going to share that with you in this article.

No matter what part of the process you’re unsure of, whether it be sourcing deals, how to finance them, or the renovation process itself, you will find the answers here!

Table Of Contents

_1. What Is House Flipping?

_2. Preparation Required

_3. Market Research

_4. Sources For Deals

_5. Running The Numbers

_6. Negotiating Deals

_7. Due Diligence Period

_8. Renovating A Flip House

_9. Getting The House Sold

10. Should You Begin Flipping Houses?

What Is House Flipping?

Flipping a house involves buying a property with the potential to be improved, renovating it, and selling it for a profit.

As simple as that may sound, each step has several sub-steps as well as many pitfalls that must be avoided. There is also a tremendous amount of preparation that successful real estate investors must do before even starting to flip houses.

However, flipping houses can be very profitable when done successfully, which is why this career has become increasingly popular in recent years.

Preparation Is Key

I know, I know… No one likes to think about spending weeks preparing before starting a house-flipping business. They just want to get in and start swinging sledgehammers and knocking out walls right away.

But building a solid team on the front end will save you lots of stress down the road, and it will also significantly improve your likelihood of success. Here are the things you should have figured out before you start putting in offers on houses.

Finding A Real Estate Agent

A good real estate agent can help you in a few ways along your house flipping journey. They can help you by providing data from the MLS (Multiple Listing Service) that will help you segment your market (more on market segmentation later).

MLS Access

Depending on where you are and the state of your market, you may or may not be able to find good deals for flips on the MLS. In areas that have hot seller’s markets, trying to find a house to flip on the MLS is like trying to find a needle in a haystack. And even if you do find one, you’re likely bidding against several other investors. Nevertheless, if you plan to use the MLS as a source of leads, you must have an agent on your team.

Comparable Sales

One part of deal analysis that we’ll get into later is running a comparable sales report to determine the After Repair Value (ARV) of a home. If you are not comfortable with performing this type of calculation, your agent can certainly help you with it. Even if you can perform the calculations, a real estate agent can pull a list of recently sold homes for you.

Selling Your Flipped House

Once you finish renovating a house, you want to sell it for the highest price possible, right? A real estate agent can certainly help you accomplish that. Although this part doesn’t come until later, building a relationship with an agent early on will streamline the process.

Getting Your Financing Lined Up

You must determine how you will finance your deals before making offers. In fact, you will likely be required to provide a pre-approval letter from a lender when submitting an offer on a house on the MLS. Even if you are looking for off-market deals, knowing exactly how you plan to fund the purchase and rehab will allow you to make offers with confidence.

Flipping Houses With All Cash

Using your own capital to fund your house flip is undoubtedly the simplest route to take. There are no hoops to jump through with lenders, you can close extremely quickly, and you won’t have to worry about paying interest during the project.

However, most people considering getting started flipping houses don’t have hundreds of thousands of dollars sitting around. Even still, it is helpful to have some cash on hand to fund specific aspects of your deals, such as down payments and repair costs. While it is possible to flip houses with hardly any of your own money, having some capital to work with will only make it easier to get started.

Home Equity Line Of Credit (HELOC)

If you don’t have a large sum of money sitting in your bank account, an easy way to gain access to working capital for your house flip is to pull a HELOC on your personal home. A HELOC allows you to access the equity in your home and use those funds like a credit card. In other words, you don’t pay interest on it unless you use it. This can be helpful for relatively quick needs like repair expenses.

Conventional Lenders

Although having access to working capital will help you fund significant portions of your house flipping deal, you will need another source to fund most of the purchase price. Working with a traditional lender can be a good option if you have a decent credit score.

When working with a traditional lender, you will likely have to make a down payment of 20% of the purchase price, so you will need access to that amount of cash.

Different banks offer various programs for real estate investors, such as construction loans that cover the rehab costs of a house flip. You should talk with several lenders and compare their programs to see which one works best for your scenario.

One drawback of traditional lenders is that they may refuse to lend on a property in major disrepair.

Hard Money Lenders

Hard money lenders are a common source of funding for those just getting started in real estate investing. They generally require less personal finance documentation and can close much faster than a conventional lender.

While conventional lenders mostly care about the borrower’s financial situation and credit score, hard money lenders are more concerned with the deal they are funding. If the ARV of the subject property minus repair costs is well above the purchase price, they will likely be willing to lend.

Although hard money lenders mainly care about the numbers of the deal, they may want to see some financial information from you, especially if you have never worked with them before. They will likely want to build a relationship with you before lending large sums of money because they want to know that you can complete a project.

The most significant drawback of hard money lenders is that they are expensive. They typically charge points to originate a loan, and their interest rates are higher than traditional lenders. However, if you build enough margin into your deal and can afford it, the speed and ease of working with a hard money lender can justify their higher cost.

Each hard money lender has their own programs with certain nuances and requirements, so it is best to build relationships with them to see which programs best fit your needs. A great way to meet these lenders is by attending your local Real Estate Investors Association (REIA) meetings.

Private Money Lenders

Private money lenders are individuals that have capital laying around and are willing to invest it into your projects for a substantial return. These lenders can be the best to work with because you can establish terms with them that work for everyone involved.

The most common structure with a private money lender is to borrow the money needed for a project while paying them simple interest at a rate that is agreed upon upfront. However, you have a great deal of flexibility and can structure the terms in a way that works for your situation. If you end up using private money lenders frequently, you may find it helpful to develop your own program that sets the terms you typically give.

The best place to start working with private money lenders is friends and family. There are multiple reasons for this. The first is that you already have a rapport built with them, so it will be easier to persuade them to lend you money versus someone you don’t know. Another reason is that once you start borrowing money from people you don’t have a prior relationship with, you will need to register with the Securities & Exchange Commission (SEC). It’s best to get your feet wet with a less complicated scenario first.

Building A Team Of Contractors

I’ll admit it. We didn’t have a complete team of contractors built when we started flipping houses. But that only slowed us down in the beginning because a large chunk of our time was spent meeting with potential contractors and getting ridiculous bids until we found the right ones.

Most articles you read about house flipping will stress the importance of having a solid team of contractors before getting started. While that would undoubtedly be nice, I come from a more practical perspective.

Sometimes the best way to find a good contractor is once you actually have a project for them to work on. It can easily feel like you are wasting your time trying to find a contractor for each niche of home renovations, especially the more uncommon ones.

That being said, having reliable contractors in the more common disciplines on your team before putting in offers will be extremely helpful. Here are some contractors you will want to find early on:

- General Contractor

- Roofer

- Painter

- HVAC Contractor

- Electrician

- Plumber

Not only will having these contractors on your team allow you to streamline the renovation process, but they will also be able to help you estimate the repair costs of a project before submitting an offer.

How To Find Good Contractors

Here are some of my favorite tips for finding reliable contractors:

- Join your local REIA’s Facebook group and ask for recommendations or search for previous queries by members

- Visit Home Depot and Lowes early in the morning and talk to contractors checking out at the pro desk

- Ask the reliable contractors you already know if they know of good contractors in other disciplines

- If you see a project going on at another house and there are contractors there, stop by and talk to them

Having The Proper Paperwork

Unless you plan to buy houses off of the MLS, you will likely need your own paperwork to document the terms of the deal. This can seem overwhelming at first, especially if you’ve ever seen the paperwork that real estate agents use.

However, you don’t need anything that extensive. Just a basic purchase agreement will do. But there are some terms that you want to have spelled out, including purchase price, closing date, and an inspection contingency. If you’d like a solid resource for real estate contracts, I’d recommend visiting Legalwiz.com.

Finding A Reliable Title Company

When you finally secure a deal, you will need a reliable title company or real estate attorney to close it with. The title company will do all of the title work and put together all the paperwork necessary to complete the transaction.

The first quality you want to look for in a title company is their responsiveness. You will be coordinating with them a lot during the period from contract to closing, so a title company that answers your calls and proactively provides the information you need will be crucial.

Another quality of a good title company is a quick turn-around time. For some real estate deals, time is of the essence. If you have your funding lined up for an immediate purchase, the title work could be the long pole in the tent. You will want a title company that can put together a closing within a week if you need them to.

Market Research

Where are you going to be flipping houses? Your local real estate market is the best place to start, but even still, which zip codes and neighborhoods will be the best candidates? This is where market research comes into play.

One of the first pieces of data you will need is the median sales price for houses in your city or county. You will want to focus your efforts on finding properties at or slightly below this value because that is where most buyers will be looking.

You should have your agent pull several other metrics for every zip code in your area. Here are some pieces of data you will need for each zip code:

- Median Sales Price

- Average Days On Market

- Average Sales Price vs. List Price

- Number of Home Sold in Last Year

- Current Number of Listings On Market

When comparing these metrics to the overall city or county data, you will see which zip codes have the most activity and will be best suited for flipping a house in.

Neighborhood Clustering

Once you determine which zip codes you want to target, you can drill down even further by finding the neighborhoods with the most recent activity. The easiest way to do this is by going on Zillow and plotting a map of recently sold homes. You will begin to see clusters of sold homes, and these clusters are the neighborhoods and areas where you want to focus your efforts.

Sources For Deals

If your market is anything like mine or many others across the country, locating a good deal with decent profit potential will likely be the most challenging part of the entire flipping process. Here are the most common ways to find a flip house.

Multiple Listing Service (MLS)

I’m just going to go ahead and say it. I rarely look on the MLS for real estate deals anymore. Our market is so hot right now that it is nearly impossible to find a profitable deal there anymore.

But hey, your market may be different. If that’s the case, your struggle may be on the selling side.

Even though it’s tough to find a good deal on the MLS, you shouldn’t rule it out altogether. You should take your findings from the market research you performed and talk about them with your agent, along with any other buying criteria you have. Then have them send you any new listings that meet that criteria. If a listing comes up that has potential, be ready to pull the trigger quickly, or someone else will.

For Sale By Owner

A free lead source is to reach out to houses in your market listed FSBO (For Sale By Owner). This could be on Zillow, Craigslist, or even Facebook Marketplace.

While many of these sellers are simply trying to keep from paying agent commissions, you will be able to uncover some that have situations causing them to sell that may enable you to buy their house for a reasonable price.

Driving For Dollars

This is the term that has been coined for driving around neighborhoods in search of vacant or distressed properties. Many real estate investors spend several hours a week doing this and are able to find deals that no one else can. Once you find a potentially distressed house, you will need to do some digging on a property such as PropStream or REIPro to find the owner’s contact information.

Direct Mail

This lead source involves pulling a list of homeowners that potentially need to sell their house and sending them either postcards or letters to let them know you’re interested in buying it. There is an entire science behind which lists to use, but the resources listed above (PropStream & REIPro) are great places to start. They even offer postcard printing and mailing services, so you don’t even have to touch the mailers.

Cold Calling/Text Messaging

This lead source has become increasingly popular in the last couple of years. It is similar to direct mail in that it requires acquiring some type of list, but instead of mailing to the prospective sellers, you call them or send them a text message. Skip tracing will typically be required to locate the phone numbers of the homeowners you are trying to reach.

Before you commit to this marketing strategy, take a moment to think about how you feel when someone you don’t know calls you randomly. Many people get very irritated with this sort of marketing and don’t mind letting the caller know about it.

Hiring a virtual assistant is an option to outsource this part of your house flipping business. Doing this will free you to focus on other aspects of the business.

Search Engine Optimization (SEO)

When you have an issue or question, where is the first place you go? If you’re like most people, you go straight to Google or Youtube.

What if when people searched for how to sell their house, your company was the top result?

That would be a fantastic source of leads!

That’s why we’ve shifted our focus from the previously mentioned marketing tactics and put all of our effort in our home buying company toward ranking on Google.

SEO is another world of its own, and this article is not the proper place to give a complete tutorial on it. But if done correctly, it can be a tremendous source of leads!

Running The Numbers On A Flip House

So you’ve got a potential deal on the line, and you’re trying to make sure you make the right offer that (1) gets accepted and (2) sets you up for a successful flip.

Congratulations! You’ve made it further than many people that try to get into house flipping.

Proceed with caution though, because offering too much could turn into a financial disaster.

Viewing The Property

Before you can accurately run the numbers on a potential house flip, you’ll need to take a look at it in person. Don’t skimp out on this step, either. I’ve often caught myself not wanting to do my due diligence while the owner is watching because it feels awkward. However, the knowledge you gain here will heavily influence your offer.

If you don’t pay close attention to the property’s current condition on your walkthrough, there will likely be numerous tasks that come up during the renovation that you didn’t budget for.

When you’re getting started, it may be helpful to bring a contractor along to help you assess what is needed to repair the house and how much it will cost. After you get some experience, you’ll know exactly what to look for and what your budget should be.

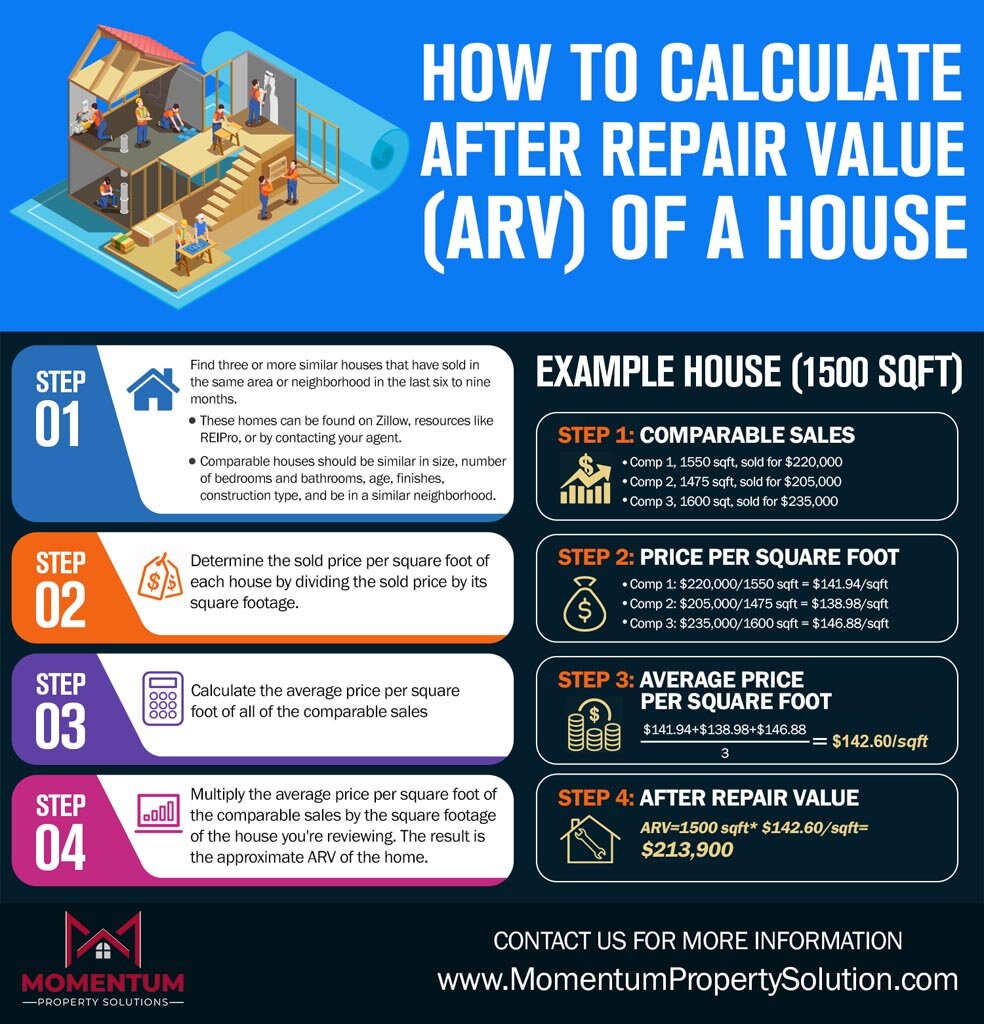

Comparable Sales

The most important part of determining how much you can pay for a real estate investment is knowing how much the house will be worth after renovating it. This value is known as the ARV or After Repair Value.

Here is a brief overview of how to run a comparable sales analysis to determine the market value of the house you’re looking at.

Determining Your Offer Price

Just take the ARV, subtract out the cost of repairs, and that’s your profit, right?

Not exactly.

There are holding costs, closing costs, and agent fees when you sell that should be accounted for when running the numbers on a flip house.

Here are the most common ways to determine how much you can pay for a property.

The 70% Rule

Nearly every article you read about flipping houses will tell you to use the 70% Rule when calculating your offer price. What is the 70% Rule?

According to the 70% Rule, the most you can pay for a property is 70% of the ARV minus the repair costs required.

For example, if you were looking at a house with an ARV of $200,000 and repair costs of $40,000, the most you should pay is $100,000.

The 30% taken out of the ARV is intended to account for holding costs, closing costs, agent fees, and your profit.

Does the 70% Rule work? In general, it usually gets pretty close. However, we like to include a little more fidelity in our calculations, and we recommend that you do the same.

The Sale Minus Expense Approach

This approach is what we use for calculating our offers. It involves taking the ARV and subtracting out all of the expenses that will be incurred during the project, as well as your intended profit. Here are the items you will need to account for:

- Acquisition Costs – Inspections and closing costs when buying

- Repair Costs – It is usually helpful to include a 10% buffer to account for extra repairs that come up

- Holding Costs – Utilities, taxes, insurance, pest control, and mortgage payments (if applicable)

- Closing Costs When Selling

- Real Estate Agent Commissions

- Your Profit

As you can see, several expenses get lumped into the 70% Rule. However, some of these items may change based on your situation. For example, if you buy a house in cash, your holding expenses and closing costs won’t be as high as when you get a loan.

Also, with this method, you can tailor your profit based on the project. We generally try to make more profit on larger projects than smaller ones. Having this granularity in your calculations will help you keep your offers competitive and give you more control over your entire budget.

Negotiating The Deal

There are numerous books dedicated to the topic of negotiation, and reading a few paragraphs likely won’t make you a master negotiator. However, here are some things we have learned along the way when negotiating real estate deals.

First and foremost, you must realize that you have to be able to solve someone’s problem to get the deal you want on their house. What do I mean by that? You’re likely never going to be able to buy a house with enough margin to flip it when you’re working with someone that just wants to see how much they can get for it. However, if there is some outside problem that selling their house will solve, they will be happy that you would even want to buy it.

If you’d like to dig deeper into the art of negotiating, I would highly recommend reading Never Split The Difference by Chris Voss. In this book, Mr. Voss divulges negotiating tactics that he developed in his career as an FBI hostage negotiator. After reading this book, you’ll understand the emotional side of negotiations that many people ignore to their demise. You’ll learn the art of mirroring and asking open-ended questions to get people talking.

Eventually, nearly all negotiations come down to some form of bare-knuckle haggling. The Ackerman method is the best approach I’ve found for this step. It involves starting at an offer lower than your Max Acceptable Offer (MAO) and increasing it with gradually decreasing intervals. For example, if the maximum you were willing to pay for a house was $100,000, you may start with $75,000, then offer $88,000, then $96,000, and finally $100,000. This gives your counterpart the feeling that you are reaching your limit and they have squeezed as much out of you as they can.

Due Diligence Period

So you got your offer accepted and put the deal under contract.

Congratulations! This event can bring great excitement as well as nerves.

Instead of waiting around for closing, you can use this time to be proactive and set yourself up for success.

Get A Home Inspection

We get a home inspection on nearly every home we purchase. Even though we never ask sellers to fix anything, we want to make sure going in that there are no hidden issues.

A home inspection generally costs between $300 to $500, but it could save you much more than that if they uncover a significant problem that you were not aware of. Even if they don’t find anything major, knowing that will give you peace of mind moving forward and a list of repairs to start on as soon as you start the rehab process.

Lining Up Contractors

It is wise to use the time between contract and closing to get some of your contractors scheduled. This way, they can begin as soon as you close instead of starting the process at that point.

You’ll have to use common sense when deciding which contractors to schedule early on and which ones to wait on. For example, any demolition you plan on doing should come first, while finish work like trim and countertops will likely come last.

How To Renovate A Flip House

If you’ve followed all of the steps so far, you are likely on a path to success!

However, be prepared to run into countless problems during this phase of the flipping process. Murphy’s Law applies here – what can go wrong will go wrong.

Stripped screws, appliances that don’t fit, and frustrating plumbing leaks are just the beginning of the unexpected issues that we’ve faced in real estate investing.

However, we will share our experience with you on successfully renovating a house.

Write A Scope Of Work – And Stick To It!

I know, as soon as you get a house under contract, all you can think about is taking a sledgehammer to that wall and laying that new flooring. I’m the same way. But a little bit of forethought can go a long way in keeping your project on schedule and budget.

In reality, you should generate a basic scope of work to determine your repair cost and calculate your offer. But at this point in the process, a detailed scope of work is vital.

Before any work begins, you should hold a thorough walkthrough and planning session to list everything you intend to do to the house. You should also include any issues that came up in the inspection report. Sure, surprises will come up, and you’ll have to adapt, but attempting to tackle a major renovation without a scope of work is like trying to produce a movie without a script. Your plan will be ever-evolving, and you’ll likely end up way over budget and schedule.

Which Updates Should I Make When Flipping House?

It may disappoint you, but I’d recommend turning off HGTV while you’re flipping houses. While you may get some great inspiration from watching these shows, you can also become disillusioned about what is actually needed to sell a home in your market.

The best way to determine which updates are necessary for your flip house is by looking at the homes that are listed or have recently sold in your area and checking what type of finishes they have. Do they have granite countertops, tile showers, and hardwood floors? If so, you should plan to put those same types of finishes in your house.

Looking at your competition will let you know which finishes you need and which ones you don’t. If every other house in the neighborhood has laminate countertops, you likely won’t get the return you’re hoping for by installing luxurious quartz countertops.

While looking at other houses will help you determine which updates to make, your list of repairs will be dictated by the home inspection report you received. You should fix every reasonable issue noted on the report and any other problems you know of with the house. This will only save you headaches down the road when your buyer gets a home inspection.

When To Use Contractors

Whether you will use contractors or rely entirely on sweat equity is one of the most significant decisions you will make when flipping a house. This decision should be based on several factors, including your budget, your skill level, the project’s complexity, and your goals as a house flipper.

Using a hybrid approach has worked best for us on our projects. We use contractors on a large percentage of tasks, primarily those that require a license or specialized skills, and we do the simpler tasks ourselves.

Here are some tasks we commonly do ourselves to give you an idea:

- Laying flooring

- Touch-Up Painting

- Changing Light Fixtures

- Basic Carpentry

- Drywall Patching

- Changing Bathroom Hardware

- General Handyman Tasks

Getting The House Sold

You’re almost there!

You’ve likely gotten some bumps and bruises from the rehab process, but you have to keep going! This is where all of your efforts pay off.

Should You Hire An Agent?

The next decision you will need to make is if you will use a real estate agent or try to sell the house yourself.

We always use an agent to list our flip houses, and we recommend you do the same. It’s tempting when you get to this point in the project to try to save the 6% commission that you’ll have to pay an agent. Believe me, I’ve done the math several times, and it definitely sounds like a lot!

However, here are some reasons why selling your house with an agent is the smarter option:

An Agent Ensures The Highest Price Possible

An agent specializes in fielding all of the offers on your property and ensuring that you get the highest price possible. When considering listing a house themselves, homeowners often plan to list the home for the price they want and wait until the right person comes along and buys it. But what if you have a dozen offers? Do you feel comfortable managing all of these relationships and ensuring you end up with the best price and terms possible? If mishandled, you could leave thousands of dollars on the table.

How Much Time Are You Willing To Spend?

Beyond ensuring that you get the best offer possible, an agent will handle all calls from potential buyers, showings, paperwork, and closing coordination. Homeowners often underestimate the time it will take to simply answer all of the calls from buyers and buyers’ agents that are interested in the house.

Creating A Bidding War

I’ll leave you with a brief story to solidify the value of a good real estate agent. We recently finished a big house flipping project and were deciding how we wanted to proceed with selling it. There were some known issues with the house that we decided were not worth fixing during the rehab phase. However, we knew these issues would come up on the home inspection and were afraid of how they would affect the sale. Even though the house was utterly immaculate and we were in a very hot seller’s market, we decided to list the home with an agent. Our main reason for this is that we wanted to get the most exposure and interest possible, and we knew that the MLS was our ticket. We ended up with several offers, and the offer we ended up accepting was well over the list price with no inspection contingency! We likely would not have gotten that strong of an offer if we had listed the house ourselves.

Getting From Contract To Closing

We’ve learned as house flipping investors that although getting a high offer is great, it doesn’t matter if you can’t get to the closing table. Here are a few tips to ensure your deal doesn’t go south during this delicate phase.

Don’t Choose Offers Based Solely On Price

When reviewing offers, you should look at all of the terms and not just the price.

Trust me. Sometimes the contingencies will come back to bite you. Big items to look for are inspections, appraisals, and the type of loan the buyer intends to use. Certain kinds of loans, like FHA and VA loans, require additional inspections and appraisals. They can be sticklers for trivial issues and make your life miserable by requiring you to fix things that don’t matter. Regarding appraisals, we’ve seen multiple examples where the seller had to give the buyer a discount because the appraisal came in significantly lower than the offer price, and the lender wouldn’t fund the deal unless the price was lowered.

Be Prepared For The Inspection

If the buyer plans to get a home inspection on your house, then just go ahead and plan on having to fix things. Take it from me. It will happen, and you’ll be much better prepared to handle it with composure if you expect it to happen. My blood starts boiling every time I get a list of repairs requested from a home inspection. But I’ve learned not to take it personally. The inspector is just doing their job.

Depending on the level of repairs requested, it might make sense to just give a credit to the buyer instead of making all of the repairs listed. It can be frustrating going back and forth with repairs until they are satisfied, so it is sometimes worth it to give a slight price concession to save yourself the hassles.

Should You Begin House Flipping?

Does flipping houses offer the potential for substantial profits? Absolutely.

Is it a way to get rich quick? Absolutely not.

Well, you actually can make a significant amount of money in a relatively short amount of time, but doing so will require hard work, dedication, and discipline.

Some of our projects have taken us six months to complete. Granted, that was with us doing a majority of the work ourselves. But you must realize that getting a property renovated doesn’t happen at the snap of your fingers.

However, if you absorb all of the information presented in this article and commit to implementing it, you will likely become a very successful real estate investor.

Even though I’ve shared the wisdom that we have gained throughout our house flipping journey, there will likely be things that you will have to adapt to. You will have to determine which marketing strategy works the best for your market and your skillset and how you will divide the renovation tasks between yourself and contractors.

In order to be successful, you must take action! If you are sure that you want to start flipping houses and are willing to put the tips given here into practice, then go for it and don’t let any obstacles stop you!

I wish you the best on your real estate investing journey!

What Are The Best House Flipping Tips?

What are your favorite tips for being successful in flipping houses?

As detailed as I’ve tried to be in this article, I know that there are investors out there with excellent knowledge to share.

If there is a strategy or secret that has contributed to your success, I’d love to hear about it in the comments below!

A hard money loan is a type of loan that is secured by real property. Hard money loans are considered loans of “last resort” or short-term bridge loans. These loans are primarily used in real estate transactions, with the lender generally being individuals or companies and not banks.

Thanks for the comment, Robert! You are correct, hard money loans should not be a flipper’s first option. However, they do have their place in the investing world.